While people often have their own views on what the outcome of a referendum or an election might be, more often than not it’s the bookies that get it right and as a result, their view is closely followed by market participants who want an impartial view on the likely outcome might be in the run-up to such an event. When it comes to trying to predict what might happen in FX markets specifically, opinion aside it is market trading conditions that can give you a real flavour of what we can expect when you dig a little deeper.

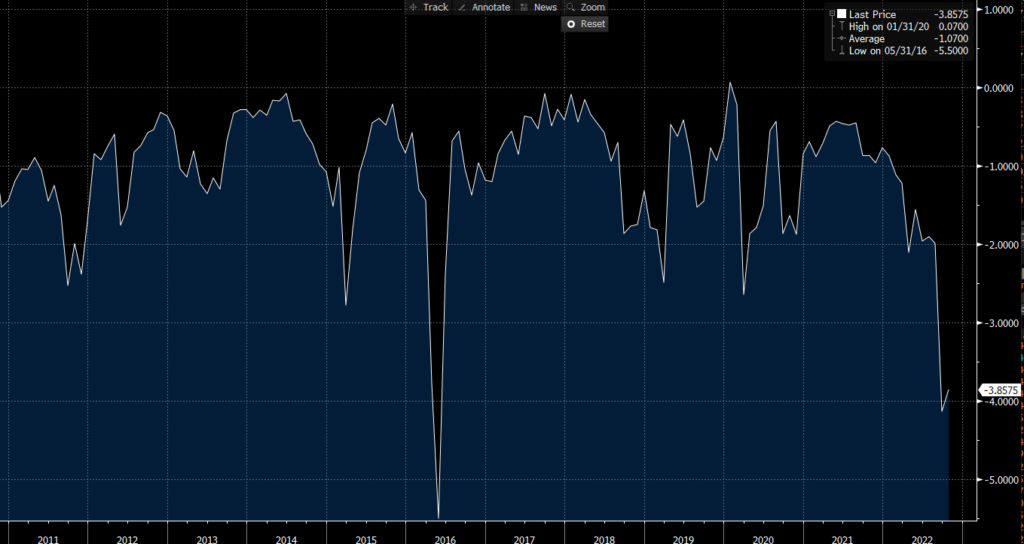

You don’t have to dig much deeper than any basic financial website to recognise that markets have been incredibly volatile in recent weeks. However, if you do want to delve into the detail a little there is plenty of information that supports that assumption, as you can see from the GBPUSD volatility chart below we are currently trading at the most stressed levels since COVID and even higher than it was currently trading at during the EU referendum vote. What this tells you is that the options market is pricing the cost of protection against movement in FX markets at extremely high levels. An equivalent analogy would be trying to buy home insurance in Florida when the weatherman is telling you a Hurricane is on the way!

The great thing about the options market is that it can tell us so much more. Everybody has a different view on whether GBPUSD is likely to trade higher or lower from where we currently are. We can also look at the options market like you would look at a betting shops odds in the run-up to an election for a firm view of what direction the market feels it’s going to trade in the future. In order to do this, we can look at what the cost of protecting against GBPUSD trading lower from here relative to what it would cost you to protect against a move higher (the piece of data is called the Risk Reversal).

A number of 0 would tell you that the cost of protecting against the downside is equal to protecting the upside. Anything below 0 tells you that the cost of protecting the downside is a little more than the upside. You can see historically this trades around -0.5 which tells us it’s a little more expensive to protect the downside but in the real world, this doesn’t translate to very much and is probably reflective of the broader trading trend in GBPUSD since the Global Financial Crisis.

However, if you wanted to buy an option today to protect against a move lower in GBPUSD, you would be paying 3.5 times more than it would cost you to protect against a move higher in GBPUSD. The only time in the last ten years this relative difference in price has been close to this was when that Sunderland result was announced in 2016!

In short despite the rally in GBP the market is pricing in with a lot of conviction in historical terms that plenty more headwinds remain and the domestic currency is far from out of the dog house yet.

The material and information contained in this document are for general information purposes only and is subject to change. You should not rely upon the material or information provided by us as a basis for making any business, legal or any other decision and should confirm the suitability of this product with the deposit taking institution you choose to proceed with. Whilst we endeavour to keep the information up to date and correct, Birchstone Markets Limited makes no representation or warranties of any kind, express or implied about the completeness, accuracy, reliability, suitability, or availability with respect to, product or services contained on in the material. Please ensure you carry out your own due diligence before entering into any contract with parties mentioned in the material or information.