2022 blew our socks off. Unforeseen and tragic events in Ukraine meant that much of the complexity and suffering the world had endured during 2020-2021 continued and bit hard, as inflation spun out of control and supply chains were tested to their limit.

In the midst of such challenging circumstances, the global community shared in the experiences of honouring the Queen and champions of our time. Queen Elizabeth II sadly passed in September to widespread grief and celebration for an incredible reign. Whilst Lionel Messi treated the world to an exhibition to settle the argument over the world’s greatest.

As one challenge potentially passes in the pandemic, another arises with the cost-of-living crisis and we certainly won’t ever forget the Kami-Kwasi budget. However, in crisis can come opportunity and we have been humbled to work with our clients as their resilience, entrepreneurialism, and spirit have been an inspiration to work alongside and is what makes our job fulfilling.

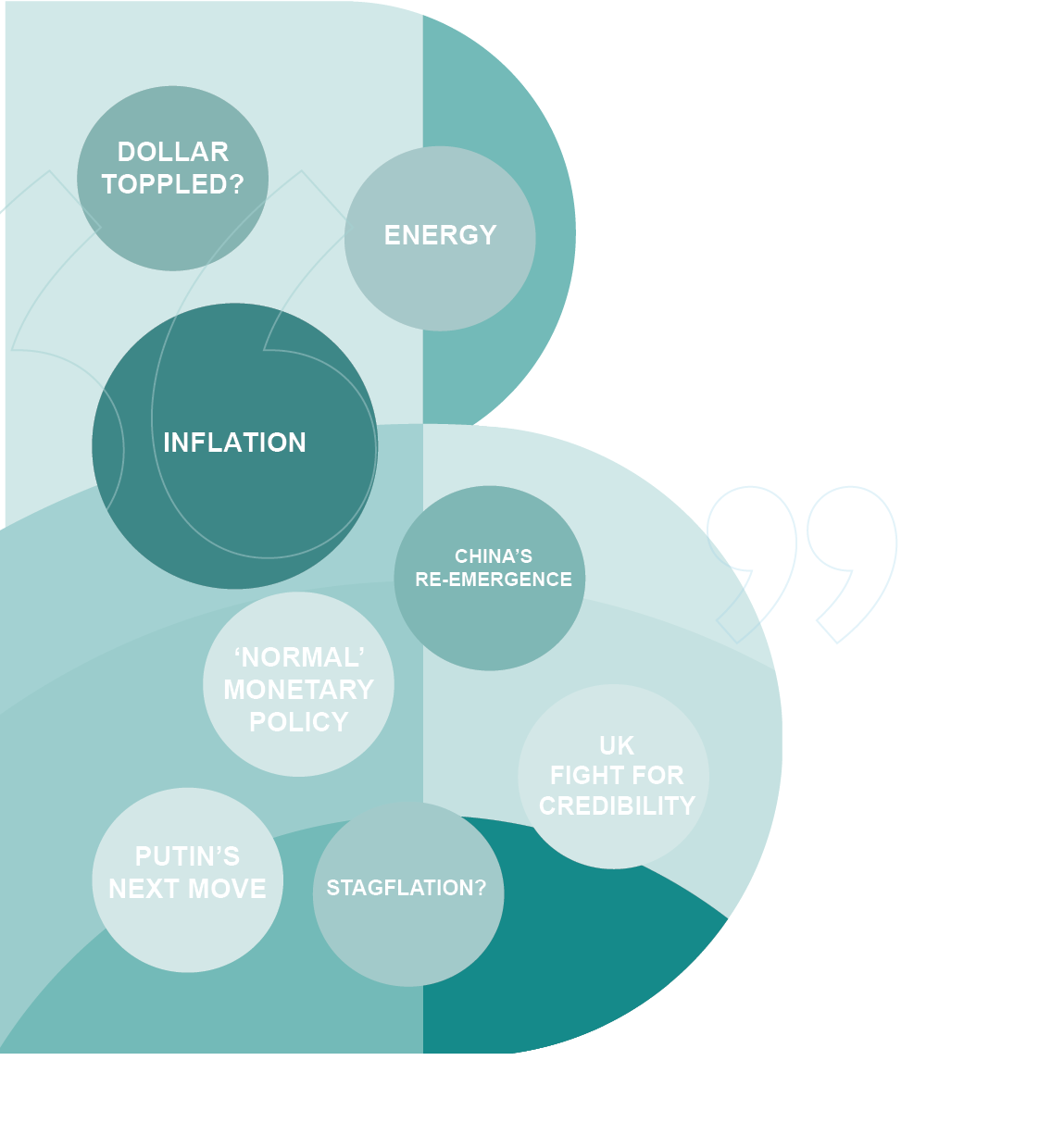

We look forward to a year ahead that brings the promise of light at the end of the economic tunnel. The year may still be littered with social and geo-political equations that governments need to solve to bring the world back to ‘normal’. As always, we do our best to offer an unfiltered, simple and entertaining slant on the key themes that lie ahead for 2023.

INFLATION VS GROWTH

A new year and a new dawn in the global economy will bring one key question. Will hyperinflation across the world be replaced with a return to normalised growth, or will current fundamentals persist and lead us to stagflation? Depending on who you speak to, where in the world you’re looking and what side of the bed you get out of, will provide an array of answers. December’s Central Bank meetings provided an outlook of stickier inflation and a very rocky growth outlook across the Western world. Whilst in China, there is greater optimism of a relative spike in growth as they emerge from Covid-zero policies, although this is tempered by growing fears of the pandemic gripping the country. One of, if not the key influence, will be the effectiveness of Central Bank policy on finding the balance between tackling inflation and avoiding a hard landing for growth. Many would argue in the likes of the UK and Europe we’ve already had a very rocky landing and we’re doomed to face a period of lower growth. Others will argue that there is an upside in growth rates due to the environment becoming less harsh with subsiding inflation and supply chains easing.

GBPUSD LOWER?

Inflation sticks, the Fed remains hawkish and the UK’s monetary policy doesn’t steer off stagflation.

GBPUSD HIGHER?

Inflation subsides, The Fed pivot and the international community believe in the Bank of England’s monetary policy balance.

CHINA: CAN THEY MASTER BOUNCEBACKABILITY?

Property market capitulation, Covid-zero policies and craters forming in diplomatic ties with vital trading partners has made the year of the dragon a year to forget, for the Chinese economy. Yet the beginning of 2023 brings with it new hope for China, post President Xi’s re-election and bold moves to end Covid-zero will see China re-enter the global arena. Ironically, China’s end of Covid-zero does appear to have triggered renewed concerns about Covid globally as the threat of new variants reminds us that the threat of social, health and economic disruption is still present. This in itself is arguably the country’s greatest ongoing risk as hospitals struggle to cope with cases and the death toll is suggested to be much higher than official figures suggest. Another key risk to China’s re-emergence as a global economic orchestrator will be the damage done in their perceived ties with Putin and Russia, albeit they have made strategic attempts all along to distance themselves from Russia’s assault on Ukraine. Greater diplomatic tension may arise in their ongoing attempts to establish partnerships with the Gulf Cooperation Council and ongoing efforts to establish institutions such as BRIC (a group formed from the likes of Brazil, Russia, and India to create a supply chain powerhouse). If we make this just about the economics, a fully firing China should largely be very positive for global growth. We believe the advantages to this outweigh the risks but it’s worth keeping an eye on whether China’s greater consumption of energy creates endured pain in energy prices throughout this year alongside, ongoing geo-political tensions between China and the US.

GBPUSD LOWER?

China’s return to economic prominence results in a further bubble in energy prices and bubbling geo-political tensions. Investor sentiment will mean the dollar remains firm.

GBPUSD HIGHER?

China makes a seamless re-entry to the global stage, smoothing supply chains both in terms of logistics and price pressures, supporting growth in the G7. Risk-on and a fundamental positive for the UK economy as a net importer.

RUSSIAN AGGRESSION: THE BEGINNING OR THE END?

Unfortunately, 2022 will likely be remembered, globally, for Russia’s invasion of Ukraine. A tragic and unnecessary war which has heralded the next chapter in Putin’s wrestle with Russia’s neighbour state and the broader NATO organisation. The food and energy crisis were unforeseen and are likely to continue into at least the first half of this year but beyond the dire economic consequences, the bigger question on Government’s minds is “Will Putin go beyond Ukraine” and in this new era of tougher diplomatic conditions, where will the next conflict arise. Despite spine tingling threats from the Russian leader, the base case in markets right now is Russia’s aggression will be limited to Ukraine. For Russia to use nuclear weapons in Ukraine will almost certainly trigger a major escalation in the response from NATO which is most likely to go beyond economic sanctioning and involve military warfare. Whilst Putin is unpredictable, the base case expectation is that the war in Ukraine will continue and will be more protracted than ever imagined. It will be contained to Ukraine and therefore negative consequences relating to supply and inflation will continue. But, economic fallout is expected to be far less severe as countries have had time to adapt to conditions. Elsewhere in the world, there won’t be many more on guard than the Taiwan military after a series of threatening exercises from China in the Autumn of last year whilst usual suspects such as Iran and North Korea remain predictably unpredictable.

GBPUSD LOWER?

An intensified war on Ukrainian territory or worse, a threat on a neighbouring NATO state will see a flight to safe havens such as the dollar.

GBPUSD HIGHER?

A retreat by Russia from Ukraine territory and geo-political risks take a very healthy turn.

UK’S FIGHT TO WIN BACK CREDIBILITY

We will all remember where we were, in that notorious week at the end of September, when the phrase Kami-Kwasi economics was born. In quite an astonishing chain of events Liz Truss was only in her premiership for just under two months, leaving UK credibility and financial markets in tatters. Rishi Sunak was parachuted in, 2023 will provide a very stern test to his economic and leadership credentials. We ended the year with inflation slightly below 11%, interest rates continuing to look likely to creep higher and a consumer that is paralysed by falling real incomes and a cost-of-living crisis. UK bond markets did settle through the last two months of 2022 and Sterling lead the charge to demonstrate to markets that the UK has finally got a grip on its financial risk. However, deep fiscal challenges remain for the Government. Can they demonstrate in 2023 that they can protect economic growth, manage down inflation and begin to fill the hole in the UK balance sheet? That’s a very steep challenge in itself, but against the backdrop of a subdued global economy and ongoing supply chain price pressures, it will be almost impossible for Chancellor Hunt to do enough to convince international markets that the UK has turned a corner. A dynamic to watch out for this year, which could see the Pound have a sharper rebound, is an improved risk environment coinciding with GBP remaining relatively weak. UK assets could look like a bargain in that scenario and if that triggers a wave of investment into the UK and particularly the FTSE, it could influence the Pound’s valuation.

GBPUSD LOWER?

Macro fundamentals don’t recover whilst ongoing global market instability expose more skeletons in the cupboard for the UK financial system.

GBPUSD HIGHER?

Hunt and Sunak become a beloved double act, with economic data giving investors confidence the ship is turning.

WILL THE DOLLAR BE TOPPLED?

Not since the Plaza Accord in the 1980’s have we seen such broad Dollar strength as in 2022. The Plaza Accord was a coordinated measure to weaken the Dollar to rebalance the financial system. Will such intervention be needed this time or is a cyclical bout of Dollar weakness on its way anyway? The latter is the popular view. Whilst the Fed is likely to remain determined in its mission for price stability which means its terminal rate could stay above 5.0% to give itself a chance of a 2% inflation target. They will not be as hawkish as the year passed when they raised interest rates by over 4%. A calmer Fed, alongside potentially calmer seas in geo-political risk offers the potential for a significant correction in the US Dollar and many financial market geeks will remind you that when the Dollar does incur cyclical weakness, it crumbles. However, a correction is not a given and it can be argued we have already witnessed the first phase of this (EURUSD has climbed from 1.06 back to 1.07, GBPUSD has recovered from 1.03 back to highs in the 1.24’s and USDJPY has witnessed a major turnaround falling from 1.50’s back to 1.30). Whilst the world may not be back to full health it still feels like it will be in the treatment room for H1 as investors remain anxious and if this plays through, the Dollar will remain in vogue for risk-averse investors. The other key dynamic that could support ongoing Dollar strength is that economic data across the Atlantic is holding up and inflation is demonstrably cooling. If there becomes a chasm between economic health in the US versus the rest of the world, particularly Europe, there may be little reason for investors to exit the Dollar any time soon.

GBPUSD LOWER?

Even modest ongoing support for the dollar through yield differential or a risk-off play will keep GBPUSD subdued.

GBPUSD HIGHER?

The market is no longer afraid of the Fed, global markets turn to risk on and the UK economy doesn’t self-implode.

WHAT IS THE NEW NORMAL FOR CENTRAL BANKS?

If you thought monetary policy was never more apparent than last year, that was only because there was such a shift in general policy. This was the shift from, accommodative policy, where Central Banks were happy to pump money into the system in an almost addictive fashion post the Global Financial Crisis of 2008, to tighter policy where central banks were forced to hike rates in order to dampen demand and tackle inflation. The year ahead is arguably more pivotal for the years to come. Some will argue that last year’s monetary tightening through interest rate hikes and the shrinking of balance sheets was driven by the hyperinflation we’ve witnessed that forced central banks into a policy shift. This may be the case but the bigger question for 2023 is whether this will stick. If inflation softens as expected, Central Banks will be left with a dilemma; do we hold at more normalised rates and monetary policy, or are we tempted to revert back to the likes of QE to stimulate economies that are scrapping for economic growth? The general trend appears to be that 2022 has brought a seismic, and overdue, shift in monetary policy to a more sustainable place where rates have lifted from zero and Central Banks have pulled away from propping up economies. However, this is easier said than done and if growth rates and unemployment don’t find the right trends, whilst inflation does prove to soften, expect to see friction in Central Banks worldwide on whether to hold firm on contractionary monetary policy.

GBPUSD LOWER?

Inflation sticks, the Fed remain hawkish and the UK’s monetary policy doesn’t steer off stagflation.

GBPUSD HIGHER?

Inflation subsides, The Fed pivot and the international community believe in the Bank of England’s monetary policy balance.

EUROPE – BACK FROM THE BRINK?

In its darkest hour last year the Euro-Zone was facing the stark reality of running out of power, soaring inflation, Brussels in diplomatic tatters and a war on its doorstep. No wonder that sentiment turned sour so quickly on the continent, with some shocking economic figures to prove it, even from the usual saviour of Germany. Yet as we enter 2023, architected by some savvy fiscal stimulus from Brussels and a very welcome mild winter, to say things are looking up may be classed as an understatement. At a macro-economic level there are significant signs of hope and the ECB’s recent hawkish rhetoric and return to positive yields is the sprinkles on top for currency markets that have had to navigate negative yields in the Euro for the last 8 years. The outlook has dramatically improved but in keeping with much of the outlook, it’s too early to become complacent. Inflation is falling but still at uncomfortably high levels, whilst the reliance on Russian gas is still a big problem despite huge efforts to diversify. We’ll be watching the weather forecasts and economic forecasts in equal measure this winter to gauge the extent of any Euro resurgence.

GBPUSD OUTLOOK – RIDING THE DIP

2022 was an astonishing year for GBPUSD, crashing to all-time lows in the 1.03s, having started the year on the cusp of 1.4000. Whilst we know that GBP more than tripped over itself in the autumn ,when UK markets had a mini cardiac arrest post the Truss-enomics, the key driver behind the depreciation was the supremacy of the Dollar. Therefore as we look ahead to this year, we remain mindful that GBP will only have a supporting role in what will play out in GBPUSD.

Jerome Powell, the Head of the Federal Reserve, will be the puppet master of financial markets and the sensitivity of the Dollar will mean that this has a very direct impact on GBPUSD. In December we saw the Fed give a resolute message to markets that the Terminal Rate is expected to get to 5.1% and they will keep rates higher for longer “until the job is done” and the Fed brings down inflation. For as long as this phenomenon remains, the Dollar will hold a notable amount of the support that it has gathered in the past 12 months and this is why we think the risk is on the downside in GBPUSD for H1. It’s important to note that if the Fed does turn more dovish or the global economy begins to show better health in growth forecasts and business surveys (and watch out for Q1 earnings reports from the giants of industry), a risk-on environment is the most likely catalyst to challenge this view of a modest dip in GBPUSD in the months to come.

Looking further out into 2023, we do believe there is significant likelihood the stack of long US Dollar positions built up across the globe in recent times will begin to unwind and therefore the Dollar will weaken. The phasing out of severe geo-political risks, an improved macro-economic picture in the second half, and broad market corrections appearing are all factors that we believe will drive GBPUSD higher in H2. This will be as long as the environment in the UK is anything other than disastrous and with inflation still above 10.0% and local elections scheduled for the spring, never rule it out! It may take some time to return to ‘normal’ levels in GBPUSD up closer to 1.4000 but we do believe we will steer higher through the 1.20’s at some point later in the year.

GBPEUR OUTLOOK – CAUGHT IN THE CROSSFIRE

Many argue we are entering a new era for the Euro. It appears the days of negative rates are behind us and the European Central Bank delivered a surprisingly hawkish tone on the eve of 2023, which has propped the Euro up in recent weeks to establish itself in new ranges against major currencies. With our fundamental view that the dollar will remain strong in the months to come, we will cap our optimism in EURUSD short-term. However, as the year rolls on there is a potential dynamic for a sea change in investor sentiment that could play into the hands of the Euro.

As we see a more normalised market environment and energy backdrop, our expectation is that confidence will grow in the Euro-Zone, fundamental economic performance will improve and in light of higher yields, the single currency will become a viable alternative to diversify away from Dollar holdings. Therefore, we believe the Euro may enjoy a strong year in 2023, which when considered against a tepid GBP, begs the question; could GBPEUR veer a lot lower?

By the nature of how GBPEUR typically moves we would not get over-excited about huge swings but we do believe a 3-5% grind lower could emerge throughout the course of the year. Much of this will depend on the energy crisis in Europe abating, which appears the direction of travel, with the collapse in gas prices at the turn of the year. GBP could put up a fight and we’ve seen this year that it’s comfortable to creep up the high teens in GBPEUR even against a backdrop of poor sentiment towards the pound. But, our hunch is that 2023 may be different and we could be set to see lower ranges as investors have the appetite for a positive yielding single currency and see value there as Europe steers itself away from an energy disaster.

The material and information contained in this document are for general information purposes only and is subject to change. You should not rely upon the material or information provided by us as a basis for making any business, legal or any other decision and should confirm the suitability of this product with the deposit taking institution you choose to proceed with. Whilst we endeavour to keep the information up to date and correct, Birchstone Markets Limited makes no representation or warranties of any kind, express or implied about the completeness, accuracy, reliability, suitability, or availability with respect to, product or services contained on in the material. Please ensure you carry out your own due diligence before entering into any contract with parties mentioned in the material or information.